Print Friendly Version

Print Friendly Version

The Optimal Pair: 401(k) + Cash Balance Plan

Some consider Cash Balance Plans (CBPs) to be the next generation of qualified retirement plans. The size of the CBP market exceeds $1.3 trillion[1] and is growing—up 60 percent in the last three years. Financial advisors should take note of this burgeoning movement that could increase their assets under management (AUM) and help business clients thrive both now and in retirement.

The reasons CBPs have caught the attention of successful businesses with the right make-up are many. Perhaps the main reason such business owners are interested in CBPs is to achieve higher contribution and tax deduction limits than those available in defined contribution (DC) plans such as 401(k)/profit sharing plans. Currently, there are approximately 23,000 CBPs with 10 million participants.[2]

CBPs are a type of DB plan structured, specifically, to meet the increasing contribution and equity objectives of professional service firms and other high earning individuals (e.g., attorneys and health practitioners). CBPs provide a tax-advantaged wealth accumulation strategy for owners of the right firms. Such plans typically supplement a firm’s existing 401(k)/profit sharing plan and provide all of the following advantages:

- Income deferral opportunities far beyond DC limits,

- Flexibility around who is covered and the contribution level,

- Tax-deductible contributions that are assets protected from creditors (unlike nonqualified deferred compensation plan assets),

- Lump sum payouts available for rollover or Roth Conversion and

- Transparency regarding the cost of each participant’s benefit.

“But don’t I have to be an actuary to sell CBPs?”

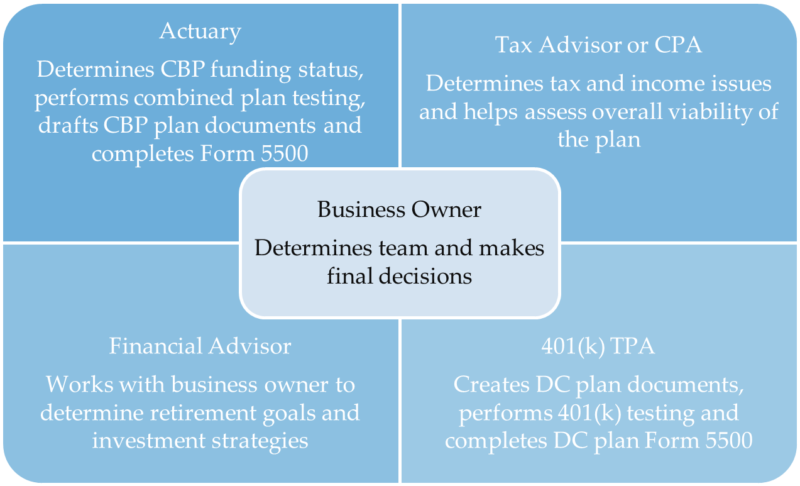

Let’s oust this myth right off the bat. Some financial advisors are intimidated by CBPs and avoid them, hiding behind the excuse, “I’m not an actuary—I can’t sell cash balance plans!” The truth is—advisors do not have to be actuaries to sell CBPs. They can partner with a firm or other entities for plan design, administration and actuarial services. The advisor’s role is to place the assets for CBPs on their usual wealth management platforms and get compensated just as they would with other assets under management. In fact, CBPs are easier for an advisor to service than 401(k) plans. For that reason, CBPs are a simple way to increase AUM without the usual DC plan headaches as long as the right team is assembled.

And 2023 is an unusually good year to prospect existing CBPs. Poor 2022 investment returns coupled with fixed rate interest crediting plan design has negatively impacted the contribution planning of plan sponsors. Existing CBP plan sponsors may be receptive to design changes—moving to a market return to stabilize plan contributions going forward.

How much more in contributions?

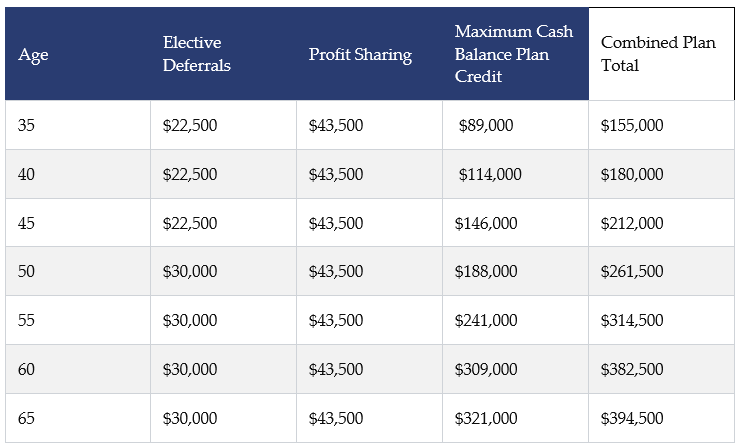

Total deductible contributions to a CBP can be two to four times more than contributions to a firm’s existing qualified DC plan. For 2023, DC plan contributions “max out” at $66,000 for participants under age 50, and $73,500 for participants age 50 and older. CBP contributions for an individual for 2023, potentially, based on a participant’s age and plan design, could be over $300,000—with a combined contribution total between a CBP and 401(k) plan nearing $400,000.

Because successful business owners often want to put away higher amounts than what a DC plan alone can provide, CBP plans are usually paired with a business’s existing DC plan—like a fine wine or favorite brew with a savory entree. Because a CBP is a type of DB plan, contributions can be in addition to and much larger than those allowed in DC plans. CBP contributions often are in addition to the amounts contributed to a business’s DC plan and, typically, vary based on a participant’s age, compensation level and/or employment group. The combination of plans can allow for much higher deductible contributions as the following table illustrates.

Assumes a 5% actuarial equivalence interest rate, 5% interest crediting rate adjustment, 5.5% lump sum conversion, discounting to the IRC Sec. 415 dollar limit from age 62, and maximum compensation for 2023 of $330,000

As displayed in this table, the maximum CBP contribution opportunity increases with age. Coupled with the maximum DC amounts from elective deferrals and profit sharing, the table shows the maximum deductible contribution opportunity available across all qualified retirement plans. While it may be appropriate for some key employees to have contributions at the highest levels, for others it may not. The flexibility built into the overall program is designed to meet the individual needs of each key employee.

Prime CBP Prospects

Firms that specialize in CBPs have found that the following industries are most likely to be interested in a CBP:

- Medical specialty groups (think radiologists or imaging centers, anesthesiologists, orthopedics, gastroenterologists, etc.)

- Law firms

- Capital investment firms

While those are the “big three,” other prime prospects, including the following, have shown interest:

- Engineering Groups

- Accounting Firms

- Architectural Firms

Cash Balance Plan Designs

Cash balance plans are a type of DB pension plan that provides participants and beneficiaries with a promised retirement benefit. That means they carry with them a funding obligation that lies with the plan sponsor. Although a CBP is a type of DB plan, it looks more like a DC plan. Increases and decreases in the value of a CBP’s investments do not directly affect the benefit amounts promised to participants. Thus, the investment risks and rewards on plan assets are borne by the employer.

Similar to a 401(k) plan, a CBP is expressed as an account balance (albeit hypothetical). In reality, CBP assets are managed in a pooled trust rather than an individual accounts. It is a DB plan that has been structured specifically to meet the increased contribution and equity objectives of professional service firms. Unlike a traditional DB plan, a CBP has the look and feel of the firm’s existing DC plan where each participant has an “account” that grows each year with contribution credits and interest credits.

In a typical CBP, a participant’s account is credited each year with a pay credit (such as five percent of compensation from the employer) and an interest credit, often referred to as the “interest crediting rate” or ICR. The ICR is important, as it can be a key driver of how much risk and volatility is present within a plan design. The first way a plan can credit interest is by using a fixed ICR. Prior to 2007, all cash balance plans used a fixed crediting rate. In this case, the plan simply adds a set percentage to a participant’s account at the end of each year. For example, if the balance at the beginning of the year is $10,000 and the ICR is a fixed 4%, the participant gets $400 added to his/her account at the end of the year, regardless of the performance of the underlying assets.

A fixed ICR can be frustrating to plan sponsors and service providers. When the promise does not align with the underlying rate of return, contributions become volatile (either much higher or much lower than anticipated) in order to get assets back in sync with promised account balances. Not a desirable outcome for plan sponsors. For this reason, most prefer to use an interest credit where participants’ accounts grow with actual trust returns. This is called a market rate return CBP. This minimizes the risk and volatility present in fixed-rate CBPs. Note: If actual returns are used, a participant must receive at least the promised contribution credits, or, put another way, a guaranteed zero percent return over the lifetime of participation in the plan. The ICR for newer CBPs (after 2006) is often tied to the underlying investment returns to minimize risk to the plan sponsor and create a promise that behaves similarly to the way a 401(k) plan operates.

Conclusion

There is every indication that CBPs are the next generation of qualified retirement plans, offering financial advisors a new way to increase AUM. CBPs are a type of DB plan structured, specifically, to meet the increasing contribution and equity objectives of professional service firms and other high earning individuals. Oftentimes, CPBs are paired with a 401(k)/profit sharing plan to maximize qualified contributions and tax deductions. Contrary to popular belief, advisors do not have to be actuaries to sell CBPs. Partnering with a firm or other entities for CBP design, administration and actuarial services allows financial advisors to do what they do best within their exiting wealth management platforms.

[1] DOL, “Private Pension Plan Bulletin, “October 2022

[2] Ibid.