Print Friendly Version

Print Friendly Version

When Might A Cash Balance Plan Be A Good Fit?

“When might a cash balance plan be a good fit?”

ERISA consultants at the Retirement Learning Center (RLC) Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings and income plans, including nonqualified plans, stock options, and Social Security and Medicare. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

A recent call with an advisor in Illinois is representative of a common question related to cash balance plans. The advisor asked: “I know cash balance plans are growing in popularity. What types of business owners might be a good fit for a cash balance plan?”

Highlights of Discussion

The question of whether to set up a qualified retirement plan has important tax ramifications. Therefore, business owners would be best served by seeking the guidance of a tax professional when making such a decision.

A cash balance plan requires an adopting business to fund the plan to provide participants with a promised retirement benefit. Therefore, cash balance plans are most popular among smaller, well-established firms that have significant and consistent cash flow, for example,

- Law firms,

- Medical groups (e.g., radiologists or imaging centers, anesthesiologists, orthopedics, gastroenterologists, etc.)

- Engineering groups,

- CPA and accounting firms,

- Capital investment groups,

- Architects, and

- Professional consultants.

Generally, they also work well for older small business owners who are no longer making heavy investments in their businesses, and have significant amounts of pass-through income, resulting in high tax bills.

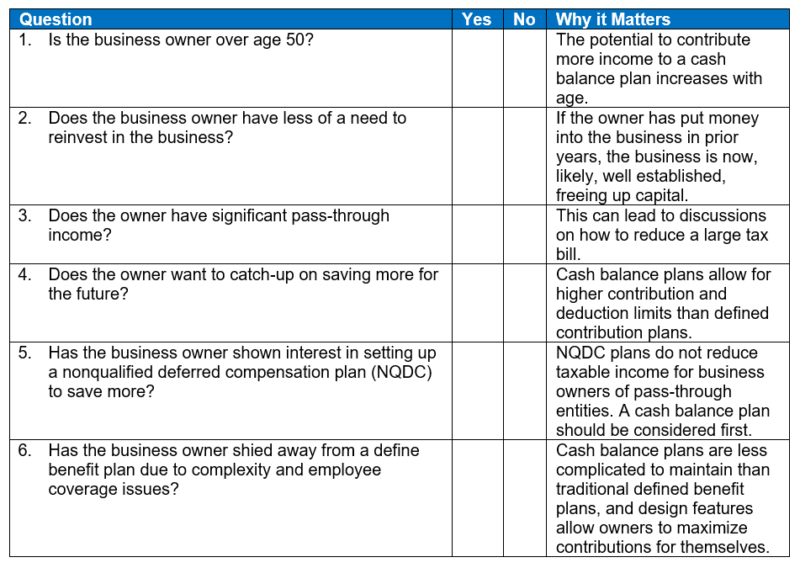

To determine suitability for a cash balance plan, consider the following questions. The more “yes” responses the greater the possibility a business could benefit from having a cash balance plan.

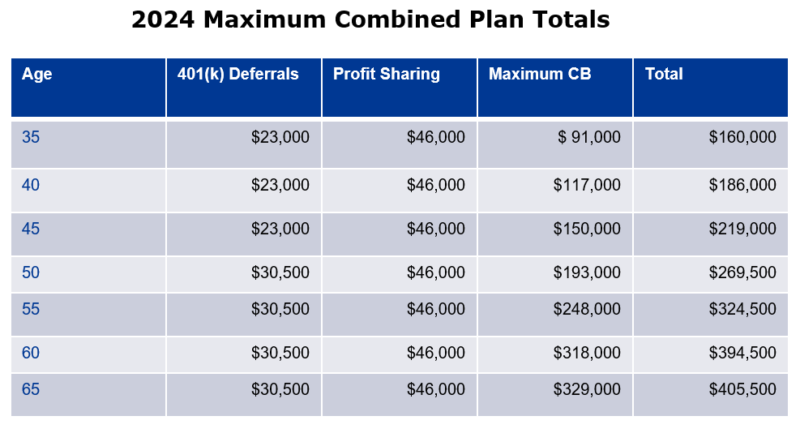

As the table below illustrates, cash balance plans can allow much higher levels of contributions than a profit sharing or 401(k) plan. That equates to higher tax deductions for business owners. For some businesses, having both a defined contribution and cash balance plan may be appealing.

Conclusion

There are some key characteristics to look for in a business owner when evaluating whether a cash balance plan might be a good fit. For the right candidate, a cash balance plan—or even a combination cash balance and defined contribution plan—can provide significant benefits. Above all, whether to set up a qualified retirement plan is an important tax-related question that a business owner should only answer with the help of his or her tax professional.