Print Friendly Version

Print Friendly Version

Delaying a Plan Audit

“My client started a 401(k) plan for her business last year on July 1. The plan operates on a calendar year basis. The recordkeeper just told my client that because her plan covered more than 100 participants last year, she has to include an auditor’s report with the plan’s Form 5500 filing. She has an extension to file, but time is running out. Is there any relief available for her?”

ERISA consultants at the Retirement Learning Center Resource Desk regularly receive calls from financial advisors on a broad array of technical topics related to IRAs, qualified retirement plans and other types of retirement savings and income plans, including nonqualified plans, stock options, and Social Security and Medicare. We bring Case of the Week to you to highlight the most relevant topics affecting your business.

A recent call with an advisor in New York focused on Form 5500 and plan audits.

Highlights of the Discussion

A little-known rule could buy your client some extra time to complete a plan audit. She should check with her tax advisor or accountant, but, generally, when a plan has a short plan year of seven months or less for either the prior plan year or the plan year being reported, an election can be made to defer filing the Independent Qualified Public Accountant (IQPA) report with the Form 5500 (see Form 5500, Schedule H Instructions).

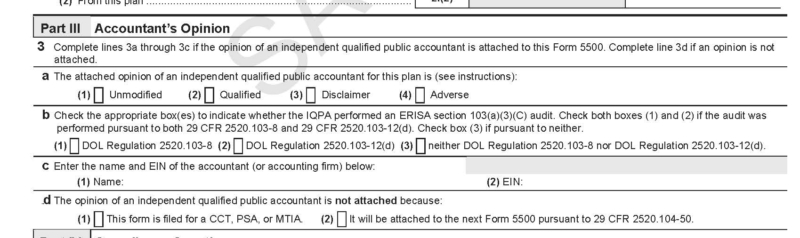

In your client’s case, because the prior year (2022) was a short plan year with fewer than seven months, your client can delay filing an IQPA until the 2023 Form 5500 filing is due (i.e., in 2024). According to the 2022 Schedule H Form 5500 instructions, she should check the box on Line 3d(2) indicating the plan has elected to defer attaching the IQPA’s opinion until the following year’s filing. The 2023 Form 5500 should be completed following the requirements for a large plan, including the attachment of the Schedule H and the IQPA report which covers the short plan year in 2022 and the 2023 plan year.

Conclusion

A qualified retirement plan with a short plan year of fewer than seven months can catch a break regarding when it needs to include an IQPA report for the plan with its Form 5500 filing. Always be sure to check the complete Form 5500 filing instructions for a particular year, and confer with a tax professional for specific guidance.